Credit analysis is one of the most critical tasks in banking and finance. Manually analyzing credit files is a cumbersome and repetitive process. These processes often lead to costly delays and errors, leaving companies at a disadvantage when it comes to opportunities in this ever-changing credit landscape.

With AI-powered technology, businesses can make smarter credit decisions faster than ever. Automate your credit analysis process with AI to save time and money while staying ahead of the competition!

Can Artificial Intelligence Assist in the Increase of Customer Credit?

The current level of AI in the banking and financial sector is high enough to affect credit assessment. This technology is widespread, and its algorithms can analyze data perfectly. That allows for more informed decisions. So if you ask how to increase credit limit with the help of AI, our answer will be - by using its algorithms.

Of course, that is not something everyone can do due to limited access to these systems. But there are other ways to increase your credit limits, such as personally contacting your issuer or bank. While everyone can do this, these financial institutions will need guarantees that you are trustworthy for such an increase.

Thus, you'll have to prove it by keeping a great credit score. You can sign up for free credit monitoring to keep track of your score easily. Maintaining it high happens by paying back on time, keeping your credit utilization under 30%, increasing your gross income, or simply reducing the outstanding debt.

Nevertheless, it does not mean it's impossible. As a matter of fact, for some time now, banks have assessed customers' creditworthiness with it. A simple example of that is your bank statement. If we consider it that way, everyone who checks their credit limits via these statements uses the help of Artificial Intelligence.

Thanks to that, AI can provide insight into when and why someone's credit limit should be increased. It's possible even if it's implemented only in some fields. That's because these algorithms allow customers to be analyzed in detail. More specifically, clients' behavior will enable lenders to judge whether they can pay back or not.

Additionally, it can calculate if a prospective borrower is trustworthy or if they can pay on time. It can even find if they have had issues returning loans. That will allow for the creation of more favorable conditions for that individual, who will later pay their loans faster and on time. Eventually, it will lead to an increase in a person's credit limit.

How Can AI Impact Credit Analysis and Why

The never-ending advance of modern technologies has led to using AI in banking and many other spheres. That includes the private lending sector, where AI does things faster, more accurately, and in many cases, more efficiently than humans.

In the past, credit analysis was a complex manual process that heavily relied on highly educated individuals. Their judgment, knowledge, or intuition to make decisions. Yet, with these rapid advancements in modern tech. Many processes, like credit analysis, have become almost entirely automated. Mainly because the benefits far surpass all traditional methods.

A great feature that Artificial Intelligence has is its speed, which is among the most impactful factors in credit analysis. With its algorithms, any task can be completed within seconds. That's because the machine can calculate and work with data exceeding the capacities of manual approaches. This factor allows lenders to make a quick decision when deciding on whom to borrow money from and what is the prospective risk.

Another important aspect of every calculative financial decision made by AI is that it's precise. We can easily say that Artificial Intelligence has the upper hand. Its algorithms most often surpass human capabilities.

It can avoid mistakes many people make and suggest how to solve problems. That leads to a more accurate analysis of any credit procedure or application. Such technologies can aid any lender in making more profitable decisions while reducing risk.

Overall, the impact AI has on banking, and credit analysis is immense. Not only does it affect many processes' speed and results, but it can even study customer behavior. That allows every financial institution to make more informed decisions and plans when offering loans. Additionally, we can say that the increased speed of these processes. And the perspective of better offers that come as a result can satisfy the customers.

What Can AI Do for the Credit Analysis Business Field

There are plenty of uses for Artificial Intelligence. Most of this complement and use its main features: speed, accuracy, or analytical abilities. That puts machines ahead of many humans doing the same job. An example is all showcased implementation and improvement in a field where AI is used.

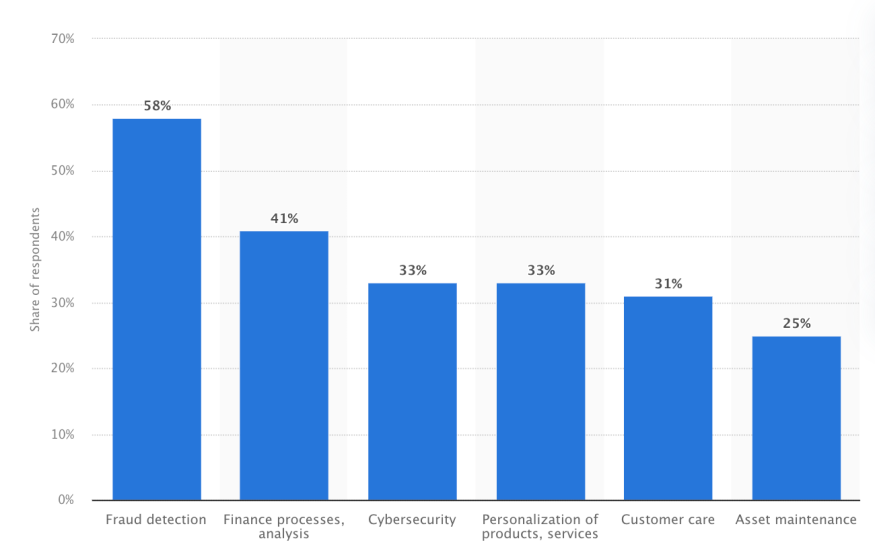

We can highlight the best risk and security purposes in credit analysis, mainly fraud detection. Why is that the leading one? It's because of all the algorithms used by AI. It has been proven in multiple statistics and various research. It can not only do the work easier but also study every customer and detect suspicious behavior.

Once they do, a specific institution or lender takes precautions to solve possible problems. They can then make decisions about how much credit they should offer customers. By leveraging AI tech, businesses can provide better customer services and products. All of this while reducing risk and increasing profitability.

Bottom Line

Our research of various statistics has proven that AI has significantly impacted finance. Thanks to it, processes like credit analysis have never seen such improvements. Artificial Intelligence has made things easier while broadening many technological horizons ahead in the credit field.

Because of it, the job of banks and other institutions has become much more manageable. Ultimately, we can say that it can help them to make decisions to reduce potential risks. AI is the improvement every service needs.

© 2025 ScienceTimes.com All rights reserved. Do not reproduce without permission. The window to the world of Science Times.