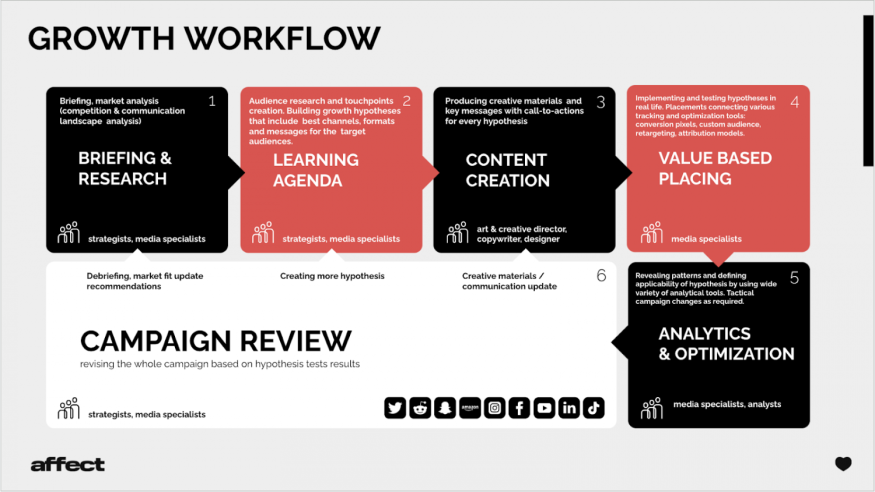

In the following article, we will embark on an in-depth exploration of the first phase of the Growth Workflow: briefing and research. Within our comprehensive 6-step growth marketing workflow, briefing and research stand as the foundational cornerstones. This phase holds the power to chart our course, guiding us to understand our current position, envision our objectives, uncover market dynamics, and decode the strategies of our competitors.

Briefing: What we need to know

Brief - this word often triggers unpleasant feelings - everyone knows we need briefs, but nobody likes filling them out. There are too many boxes and lines of text. It's confusing and tiresome. We know what we want! We don't need to put it on paper. Familiar situation? We understand. But a well-filled-out brief is 50% of the successful result of an advertising campaign.

What is the purpose of the brief?

It allows you to structure information, understand your goals and objectives, and define the KPIs and metrics to achieve a successful campaign. Sounds great, but how exactly should one fill it out? Do not panic! We will now reveal what to do and how to do it.

What are the main points of a brief?

In our brief template, we identify five must-have categories:

A business objective - An answer to the question of what goals you would like to achieve. For example, reach the sales level of up to 100k USD in online channels with a lead cost of 36 USD. The goal must be ambitious, achievable, and measurable.

The product - What are the key features, and how is the product unique compared to analogs? What do customers say about your product?

Who is your target audience? Why do they buy your product, and what prevents them from becoming your customer? Which path is your customer going through?

Current knowledge - Growth marketing is an iterative process. Our forecasts will be much more precise and realistic if we use benchmarks and results from previous campaigns. If this data is available in advance, you can significantly reduce budgets and time.

Who is your competition? What brands or categories are you competing against in the market?

Answering these questions guarantees 80% of the brief's success.

It may appear tedious, but providing all the information you have at this stage is crucial to the future success of your campaign.

Where to search for market data and benchmarks?

You must research and analyze the key market indicators to successfully launch your campaign and to understand if it's even possible to reach the client's targets.

Your client might request a cost per lead of $36, but market practice shows the lowest result achieved was $80 per lead.

For broad categories - for example, the sale of auto insurance - the data is known, but in narrower categories - theft insurance for 5-yo Japanese cars in Wisconsin, it is usually more complicated. There may be no precedents.

What if you don't have historical data?

Finding benchmarks is difficult but possible. We share a few of our methods below. Feel free to use and adapt them, but remember to turn to sources you can TRUST - reliable research sites, the experience of big players, and professional portals.

The easiest way is by searching.

You can try to search published results and average market benchmarks. Example - using the search query "category_name CPC benchmark Facebook," "category_name adcost search report."

You can also find approximate data on various sites - statista.com, remarketer.com and forecast values of most platforms' placement costs on adcostly.com, instapage.com, and wordstream.com.

In addition to searching for examples, we recommend studying successful implementations in your segment. "Think with Google" is a good source. Use the results with % of conversions to navigate the average benchmarks by category.

If you have a complex category, you can try to find an expert (typically on LinkedIn) with implemented cases in your segment and agree on project consulting. It's easier than you would think. Everybody is a bit of a freelancer nowadays!

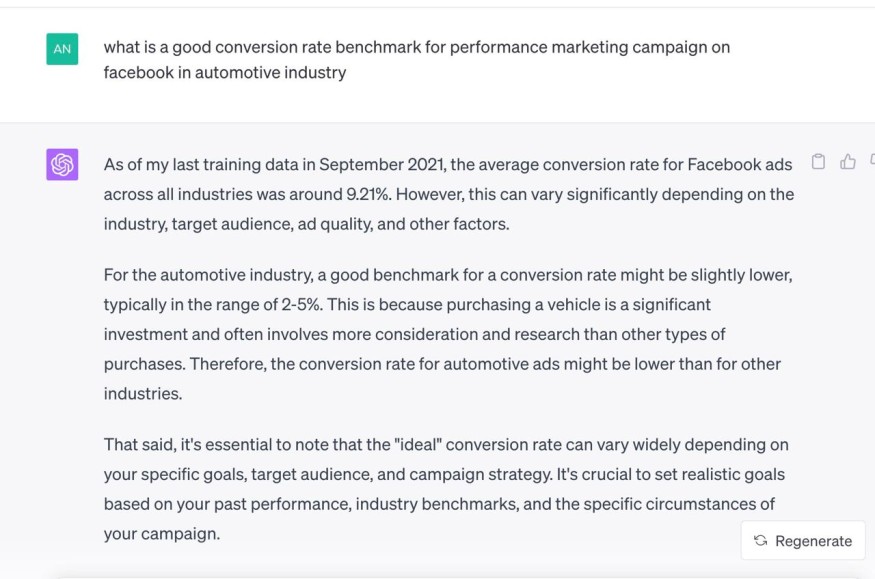

In some cases, it's acceptable to use not the most recent data, and that's when we employ ChatGPT:

Sometimes we use other Ai for search, e.g Bard, Bing and others. We often use new technologies to search and analyze data, using plugins, for example Promt Perfect or generative models API.

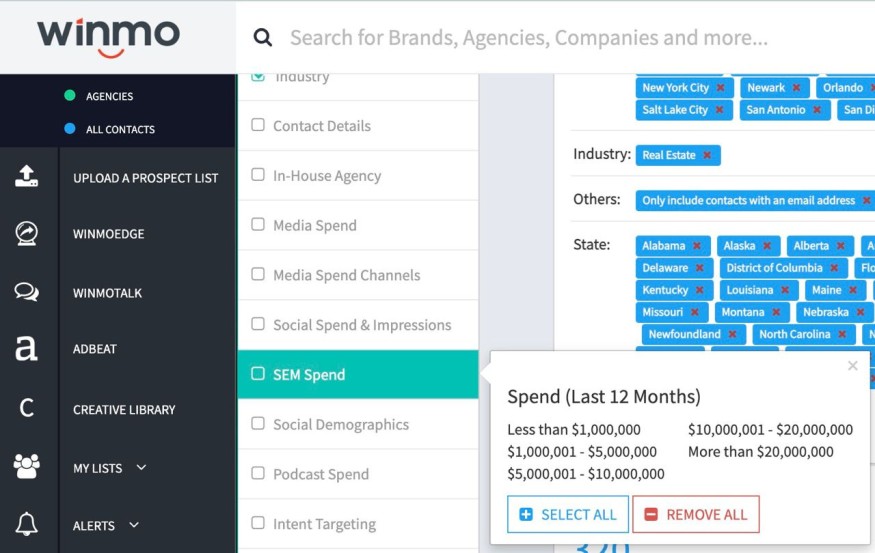

Another common method for data retrieval is through various data collection services and technologies, such as Winmo. There are numerous such services available, and we will detail how to effectively utilize them in a separate article.

How to reverse-engineer the competition

Now that you've set the goals in the briefing phase and understood the market benchmarks, you know what your dream advertising campaign looks like.

Competitor analysis - a critical element of primary research - will help you find the tools to make your dream a reality.

Usually, large competitors who entered the market before you have already tried various formats of advertising campaigns and are scaling up the most effective ones. By collecting data on these competitors, you can use reverse methods to recreate their strategies and understand what opportunities can be most effective for you.

How to analyze your competitor's online presence.

- Study the competitor's website: is it easy to find, is the product clearly stated, is it easy to navigate?

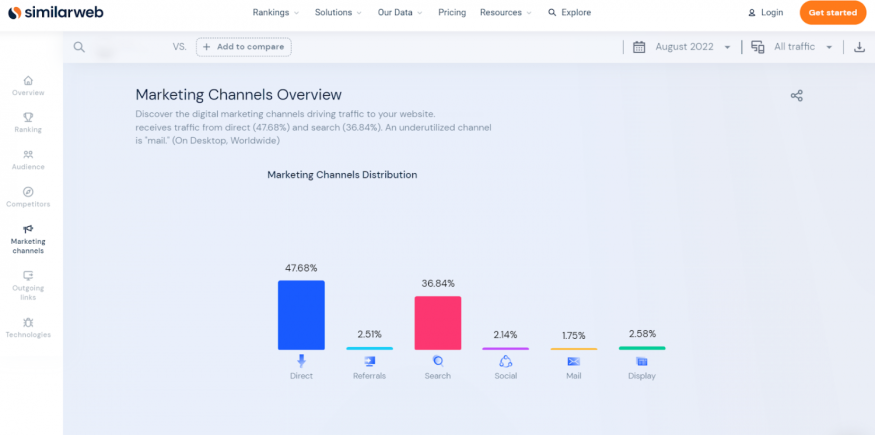

- In which advertising channels is the competitor active? You can use similarweb, for example.

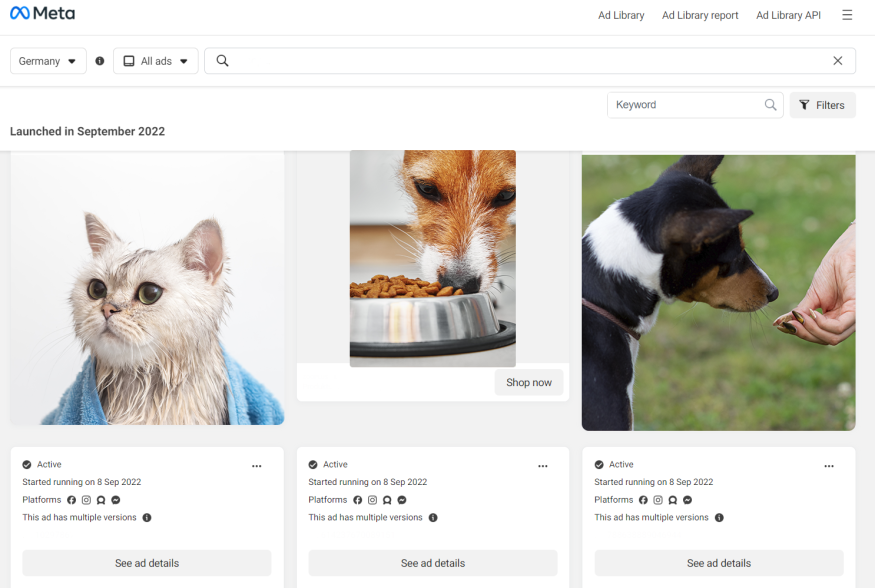

- Analysis of the competitor's social media: Which ones do they use? Search for their advertising messages through the Facebook Library Ads cabinet.

- Is it easy to find a competitor through search? Google a competitor and see where they are in the search results. For example, you can use the forecast services from Google and Semrush.

- Try to "buy" a competitor's product. It will give you a better understanding of their selling and marketing process. Go to their website and see how they optimize a purchase: is it possible to quickly order a product? What tools do they use (chatbot, push notifications, callback, email marketing)?

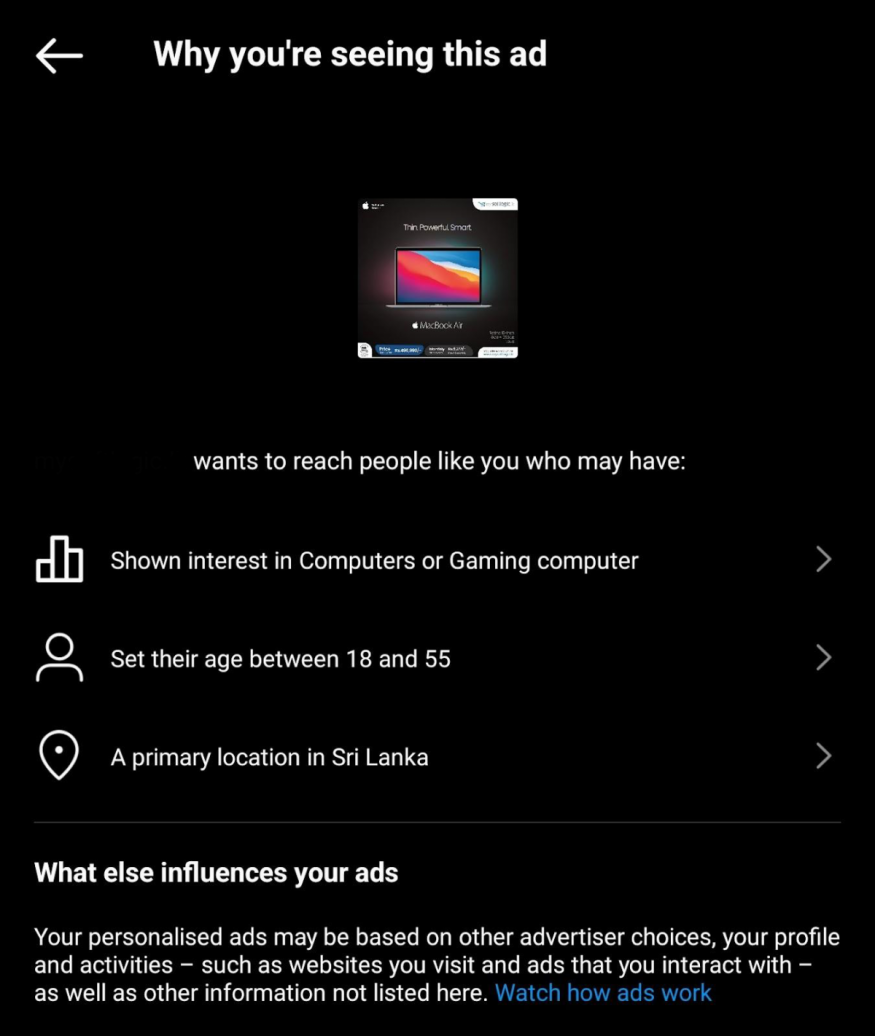

- Accept all cookies and see if retargeting and remarketing work. A few days later, you should start seeing ads for the competitor's product, and through the "why you're seeing this" function, you can learn which audience your competitor targets.

Results interpretation

We recommend combining competitors' data and comparing them along the following dimensions:

- Creatives and visuals: What messages help sell the product (for example, appeal to the price VS additional services/value of the product)?

- Number of advertising channels used: How broad is the competitors' coverage?

- Retargeting: Which tools (Google, Meta, TikTok) do the competitors use to bring back potential buyers?

- Remarketing - Do you notice ads "catching up" with you? The duration and frequency of these ads tell you how actively the competition covers the different segments.

Takeaways

The first step of our growth marketing workflow has three blocks: brief, benchmarks, and competitors.

Use the Briefing & Research phase to get:

A precise picture of what your business objectives are, your target audience, and the competition.

Defined KPIs and benchmarks that will guide you and help you evaluate the success of your advertising campaign

An understanding of your competitors' strategy and tactics; you should know what messages and offers structure they use, which audience they target, and through which channels.

With this information, we're ready for the next step of our growth marketing workflow: the learning agenda, where we will select the best advertising options to help you upgrade your online performance.

© 2025 ScienceTimes.com All rights reserved. Do not reproduce without permission. The window to the world of Science Times.