In the high-stakes world of stock trading, data analytics has emerged as a game-changer, harnessing the power of vast datasets to glean insights and predict market movements.

But how can individual investors leverage these advancements to compete in a market increasingly dominated by big data?

The following article will center on:

- The role of data analytics in stock trading

- Has it revolutionized the stock market?

- How does data analytics impact stock market decisions?

- Challenges and opportunities for using data analytics in stock trading

Data Analytics in Stock Trading

Data analytics in stock trading serves as the backbone for decision-making processes, allowing traders and investors to sift through vast amounts of information to spot trends, predict market movements, and make calculated decisions.

Leveraging advanced algorithms and machine learning models, data analytics helps in identifying profitable trading opportunities by analyzing historical data, market conditions, and investor sentiment.

This analytical power can transform raw data into actionable insights, giving traders a significant edge over traditional methods of stock trading.

Before jumping into the pool, new investors should also read guides and tips that provide valuable insights. For instance, Plus500 is available in the US and offers investors a wide range of trading opportunities and resources.

Has Data Analytics Revolutionized the Stock Market?

The short answer is yes. The stock market has always been data-driven, but with the advancements in technology and the availability of vast amounts of data, traditional methods are no longer enough to stay competitive.

Even the biggest investors and firms in the world are incorporating data analytics into their trading strategies with cutting-edge tools like artificial intelligence and predictive models.

These technologies allow traders to analyze market trends and patterns more comprehensively, improve risk management, and increase profitability.

Moreover, the use of data analytics has created a level playing field for smaller investors who may not have access to the same resources as large firms.

How Does Data Analytics Impact Stock Market Decisions?

Based on pure math and statistics, data analytics can provide valuable insights into market trends and potential opportunities.

For instance, predictive models can analyze historical market data to identify patterns that may predict future stock movements.

This information is then used to make informed decisions on when to buy or sell stocks instead of relying solely on speculation or emotions.

Furthermore, data analytics also helps traders track their investments in real-time, providing up-to-date information on market performance. This allows for faster decision-making and the ability to adjust strategies as needed.

Challenges and Opportunities of Data Analytics in Stock Trading

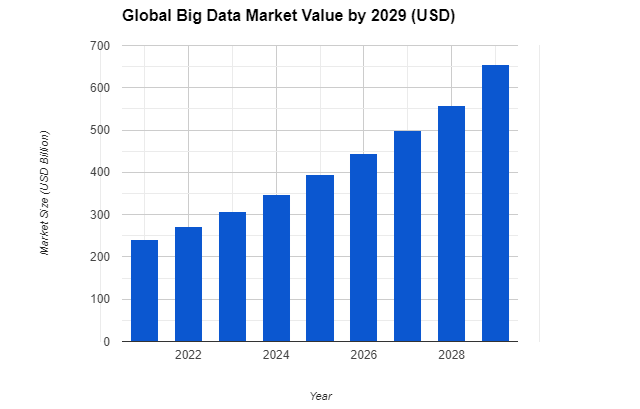

According to Statista, the global big data market is expected to reach a value of over 655 billion U.S. dollars by 2029, highlighting the growing importance and potential of data analytics in various industries, including stock trading.

However, with this growth comes challenges such as data privacy and security concerns, as well as the need for qualified professionals to manage and analyze large amounts of data.

Some of these challenges are:

Data Quality

The accuracy and reliability of data utilized for analysis play a crucial role in influencing the success of trading decisions.

Traders must ensure that the data they rely on is not only precise but also trustworthy, as even minor discrepancies can lead to significant implications in the financial markets.

Complexity

Utilizing data analytics in trading necessitates a comprehensive understanding of statistical models and programming languages.

This proficiency is crucial for traders to effectively interpret market trends, make informed decisions, and optimize their trading strategies for maximum success.

Cost

Access to advanced data analytics tools can be costly, creating a barrier for smaller investors to effectively compete against larger firms in leveraging data-driven insights to enhance their decision-making processes.

On the other hand, as mentioned earlier, data analytics can provide valuable insights into market trends and opportunities, such as:

Real-Time Analysis

With the use of data analytics, traders can make decisions based on up-to-date information, giving them a competitive edge in the dynamic stock market.

Automation

Data analytics allows for automated trading processes, enabling traders to execute trades faster and more efficiently.

Personalization

Data analytics can provide personalized insights for traders based on their individual preferences, risk tolerance, and investment goals. This allows for a more tailored approach to trading that can lead to better results.

Conclusion

In conclusion, the increasing reliance on data analytics in trading has revolutionized the financial markets.

It has become an integral tool for traders to make informed decisions and stay ahead of market trends.

However, to make the most of it, the trader must be well-versed in statistical models and data analytics as well as expertise in the stock market.

With that in mind, it is clear that data analytics will continue to play a significant role in trading and will only become more sophisticated with advances in technology.